How To Apply For Physical Paytm ATM Card/Debit Card

Apply For Paytm ATM Card Physical: Hello Friends, I hope you know about Paytm Payments Bank. In case you don’t know about Paytm Payments Bank please read I have already written about it. Physical Paytm Payments bank ATM Card is recently launched by parent company PAYTM. You can also apply for a physical debit card by doing simple steps. If you have a Paytm Payments Bank and don’t know How To Apply For Paytm ATM Card physically then this article might be helpful for you. Let’s see…

Read more: Paytm Bank Offers

Read more: All About Paytm Payment Bank

Paytm provides you Paper-less bank account. Also gives you many special benefits such as 4% annual interest rate and free transaction fee. You can use Paytm ATM card as any normal ATM card. Note that Paytm Payments Banks RuPay debit cards are only valid in India. Before applying for Paytm ATM card you need to open a Paytm Payments bank. I have already shared all requirements need to open an account in previous posts.

Features Of Paytm Payments Bank ATM Card

-

- Accepted online: You can use your Rupay Debit card across all online websites in India. You pay your online bills or purchase anything online using paytm ATM card. Bank will not apply any hidden charges from your balance.

- Withdraw Cash from any ATM: You can withdraw cash at more than 200,000 ATMs across India of any bank. Even Paytm is planning to open its more than 5000 ATMs in major cities. Paytm provides you 3 free withdrawals in metro cities and 5 free withdrawals in non-metro cities.

- Platinum card benefits: Enjoy Platinum benefits such as discounts and cashbacks across a large number of merchants. Paytm offers many cashbacks when you make transactions with selected merchants.

- Swipe at any store: You can Swipe your Card at stores across India which accept Rupay cards.

- Free insurance: You can get a free insurance cover of Rs. 2 lacs in the incident of death or permanent total disability according to the terms and conditions. You can apply for this offer after activating your ATM card.

- QR code on your Debit Card: Paytm ATM will have a QR code to receive money instantly. Anyone can scan this QR code to sends money and money will instantly transfer into your Paytm Payments Bank.

Paytm ATM Rates & Charges

1. ATM Transactions

For Metro Locations such as Mumbai, New Delhi, Chennai, Kolkata, Bengaluru, and Hyderabad Paytm provides you 3 free withdrawals every month and post that

- Cash withdrawal: Rs. 20/txn*

- Mini statement, Balance check, PIN change: Rs. 5/txn*

For Non-metro Locations Other than the 6 Metro cities paytm provides you 5 free every month and post that

- Cash withdrawal: Rs. 20/txn*

- A mini statement, Balance check, PIN change: Rs. 5/txn*

2. Debit Card Rates

How To Apply For Paytm ATM Card

When your Paytm payments bank account is activated, you will get Paytm Digital ATM Card immediately. But if you want a Physical Paytm ATM Card, you have to send a Request for it. After that, you get a Paytm ATM Card in one week. But there is some Process, after which you can send a request for Atm Card.’How To Apply For Paytm ATM Card’

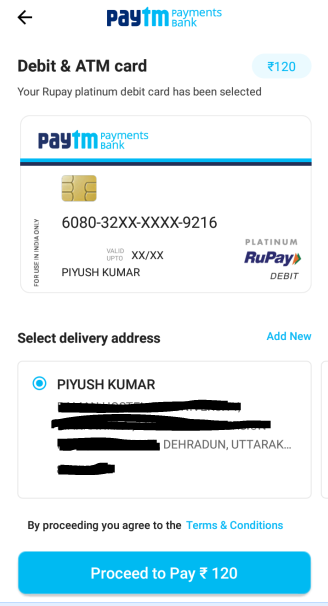

Paytm Digital debit card is available at the time of Account Opening. But if you apply for Physical Paytm ATM Card then you have to pay a one-time charge of Rs 120. That’s it you can apply for a physical card if there are at least Rs. 120 in your account.

I have applied for paytm ATM Card by paying 120 rupees. If you want to apply also, then follow these steps.

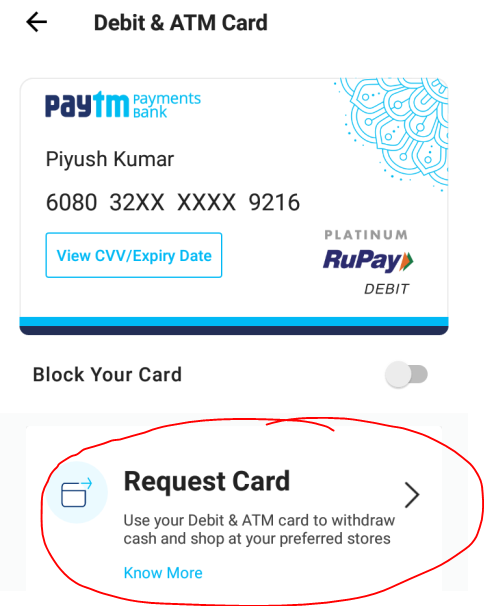

- First, you have to open the Paytm App and click on the Bank Option.

- Search Debit & ATM Card option in the Bank Option and click on the Request Card option.

- To complete the request, you will have to enter the Delivery Address with Area PIN code, followed by payment of 120 rupees, by clicking on the Proceed to Pay option and complete the Payment.

- After completing the payment, the Paytm ATM Card Application Request will be sent and Card will deliver to your Address within one week. You can also track order and know when your paytm atm card is arriving.

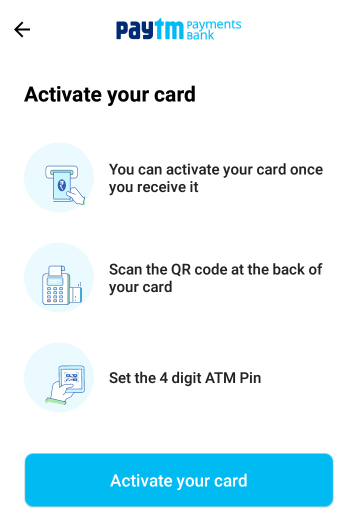

- To activate ATM Card, you need to click on the Debit & ATM Card option. After that, click on the “Activate ATM Card” option and then have to scan the QR Code behind the ATM Card. when QR Code Scan happens, you have to enter the Paytm Pass Code and verify the details, then the ATM becomes activate and setup the ATM PIN.

apply for paytm atm card

This way you can easily apply for Paytm ATM card. If you have opened an account in the Paytm Payments bank, apply today for new Physical Paytm ATM Card and get the Paytm Debit Card.

I hope you understand “how to apply for paytm atm card”. Let me know if you are facing any problems in the comment box. Don’t forget to share this article with your friends and relatives. Keep visitng Techwiki… 🙂